Smart, successful business people can make bad choices on routine business decisions that expose them to massive financial loss from a personal injury lawsuit. As an attorney for injured people, I see the fallout of these bad personal and business choices. Some defendants are not protected and risk losing their assets. In this article, I share three risk management lessons and the consequences in one particular case.

Personal Injury Case Study Background

Denny, was a successful commercial real estate salesperson in his mid thirties. He lived in an affluent neighborhood and owned investment property.

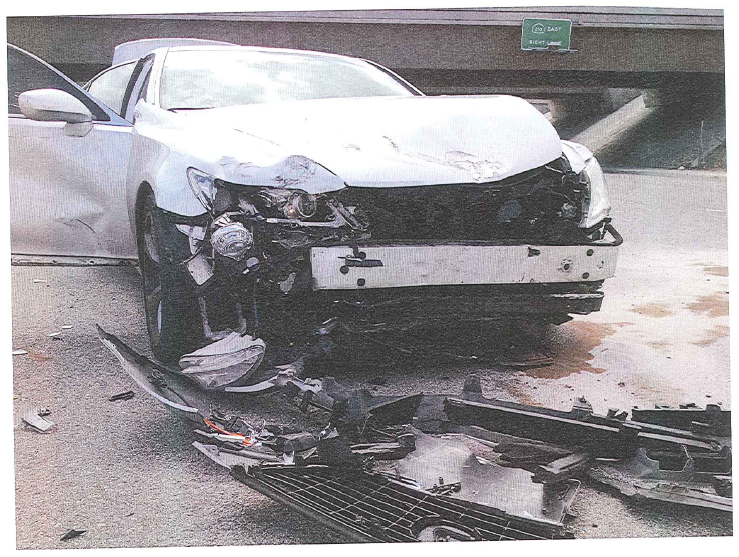

One day, he was driving straight going through a T-intersection with a freeway off-ramp. At the same time, a jeep was exiting the freeway to his right. Denny drove his car into the driver’s side of the jeep causing a major crash.

Patty, a thirty-five-year-old hardworking probation officer and mother of four, was driving the jeep at the time of the crash. She was on her way to meet her boss about a promotion.

The police came to the scene, collected evidence, and took statements. Both Denny and Patty claimed they had the green light.

An independent witness, a California traffic engineer, came forward and told the police he was driving behind Denny. The witness saw Denny run the red light.

The police concluded that Denny was at fault.

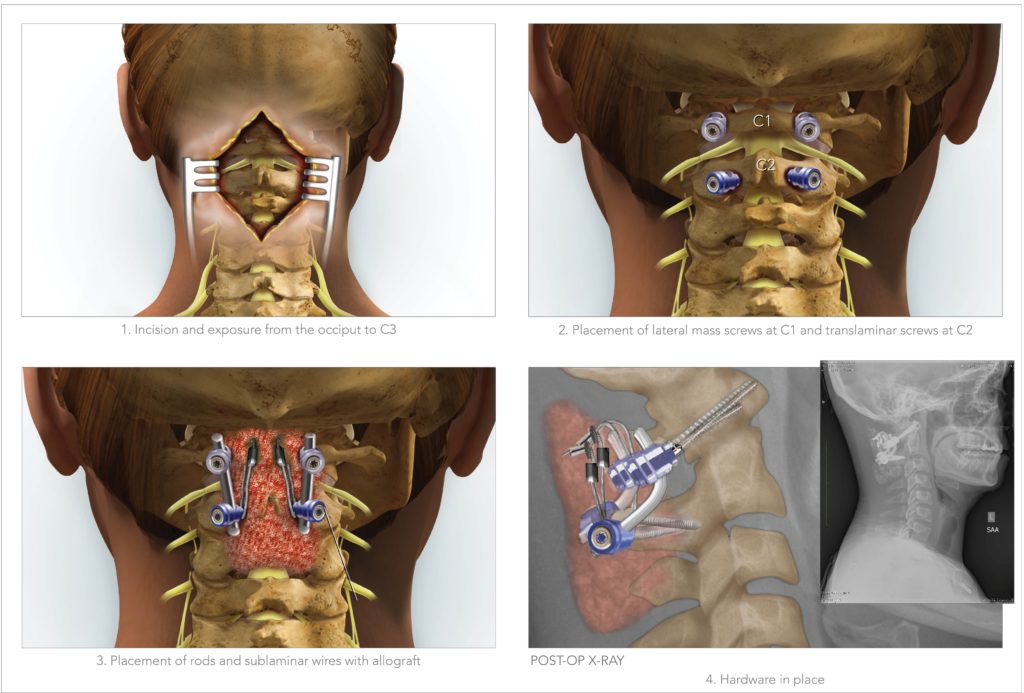

During the crash, Patty hit her head on the driver side window. The force of the blow caused her to suffer a brain injury and neck fracture that required emergency surgery. Even though the surgery was successful, she still had dizziness, vertigo, and cognitive problems. Patty had to quit her job because it was no longer safe. A minor altercation at work could cause death or further serious injury. To make matters worse, she was the primary wage earner for her family. By the time she got out of the emergency room her medical bills were already in the six figures and climbing.

Lesson One: Buy Enough Insurance

Denny’s insurance company reviewed the evidence in the case and immediately offered his limits of $100,000. They knew if this went to trial, a jury would render a multi-million dollar verdict for Patty. Unfortunately, Denny’s insurance would not even cover Patty’s medical bills.

It seemed unusual that a successful real estate salesperson would have such a low amount of insurance to cover a personal injury lawsuit from an auto accident. We hired an investigator and found out that Denny lived in a very wealthy suburb. His house had over a million dollars in equity and he owned various investment properties throughout Southern California. He also owned his own business, which was part of a commercial brokerage. We found his assets exceeded a million dollars.

Most people don’t think they would ever seriously hurt someone. It’s easy to forget that many of us drive 4,000-pound-plus vehicles at 40 miles per hour on a regular basis. We can cause serious damage if we are inattentive. Perhaps Denny was distracted by an incoming call or tired from a late night. Either way, a very credible witness saw him run the red light and now he was on the hook. His investments and savings were on the line.

Don’t be underinsured. Denny was a smart successful business person, yet he failed to protect himself from a common occurrence like a car crash. The right amount of insurance for an individual can vary, at a minimum you want as much as your assets. If you’re not sure, ask an expert insurance broker or financial planner.

Lesson Two: Be Careful Using Independent Contractors

When we first started litigating, Denny denied he was working. Later, we learned that Denny had left his office and was on his way to a meeting which is generally considered working under California Law. When you hurt someone while working, your employer is usually also responsible.

The employment situation got more complicated when Denny claimed he was working for his own company, which had no insurance. Again, we conducted an investigation and determined that Denny was actually working for a commercial real estate broker.

When we brought the broker into the lawsuit, they immediately notified me that Denny was an independent contractor. The attorney for the broker demanded that I dismiss the broker company from the lawsuit. The broker had no control over Denny, the attorney claimed. He even sent me a copy of an independent contractor agreement.

Contrary to their agreement, case law in California states that a real estate salesperson is the agent for the broker. The California Court of Appeal reviewed a similar case where a sales person caused a car crash and they held the broker liable. A broker cannot escape liability of a sales person by calling him or her an independent contractor. (See Gipson v. Davis Realty Co. (1963) 215 Cal.App.2d 190)

Even without that case, it is possible the broker would be responsible for Denny’s negligence because Denny was acting as an agent for the broker. When a principal and agent relationship is shown, the principle is on the hook. To determine whether someone is acting as an agent for a principal can be complicated. Laws vary and can change so it is best to consult an employment attorney if you’re not sure.

Bottom line–just because you call someone an independent contractor, it doesn’t mean you’re off the hook for their actions. A judge or jury looking at the agreement later might disagree. Consult an expert.

Lesson Three: Understand the Exclusions in Your Insurance policy

When Denny’s broker realized they were liable, they asked their own insurance company to start defending them. Their insurance company reviewed the evidence and determined an exclusion applied. They pointed to an unclear provision in their policy that excluded auto accident personal injury claims involving “others.”

In other words, the insurance company argued their policy excluded any personal injury car accidents caused by one of their salespersons since they were supposedly an independent contractor. But since every salesperson was legally an agent for the broker, the broker was on the hook if the salesperson caused a crash.

This exclusion exposed the broker to major risk. This broker was well established and had many sales people driving around Southern California meeting with clients and visiting properties. If one of those sales persons caused a major crash like Denny, the broker would be on the hook with no insurance protection.

Denny caused a car crash and exposed himself and his broker to a multi-million dollar claim and the only insurance was Denny’s personal coverage, limited to $100,000. The broker was not happy.

Denny, the broker, and their insurance companies were fighting amongst themselves while we were litigating our claim. The broker hired its own attorney to fight against its insurance company and to argue that the exclusion was not legal. Denny hired his own attorney to try and protect his assets and make sure the insurance companies were properly defending him. In addition to fighting my client’s lawsuit, the defendants and insurance companies were using financial resources to fight amongst themselves over who should pay. You don’t want to be distracted, fighting your own insurance company and co-defendants when you should be focused on the main injury claim made against you. The key takeaway: make sure you understand the exclusions in your policy and how they relate to the type of work you do.

Conclusion

In the end, the case settled for a confidential amount favorable to my client. Denny and the broker had to contribute personally. The broker’s insurance company had to pay on a claim it believed was excluded. And Denny’s own insurance company had to pay a lawyer to litigate the claim even though they offered the policy limits of $100,000. It did not work out how any of them planned. Actually, their problem was they didn’t plan well, if at all.

If Denny and the broker had had the right insurance there likely would have been no personal contribution or any exposure to a multi-million dollar loss.

The goal of many personal injury attorneys like myself is to recover money to pay for our client’s medical bills, lost wages, and money for pain and suffering. Our goal is not to drive defendants into bankruptcy. The system works because of insurance. But the system does not work if people are underinsured or they don’t have the right coverage.

It took about two years of litigation to resolve this case. Those two years were extremely stressful for my client. Her recovery involved surgeries, rehab, and lots of therapy. She had additional problems navigating the health care system and dealing with her own health insurance company. The whole time she was burning through savings and borrowing money from friends and family. Meanwhile, Denny and the broker were panicking about the large claim. All of it could have been avoided by understanding these three simple lessons.